[Dong Nai] Giang Dien Industrial Park

Mục lục

- Overview of Giang Dien Industrial Park project

- Location of Giang Dien Industrial Park

- Infrastructure of Giang Dien Industrial Park

- Current status of land use planning in Giang Dien Industrial Park

- Priority areas to attract investment

- Investment incentive policies

- Planning map of Giang Dien Industrial Park project

- Evaluation of Giang Dien Industrial Park

- Vietnam Property Hub service

- Contact for consultation

Overview of Giang Dien Industrial Park project

Giang Dien Industrial Park is one of the key industrial park projects in the South of Dong Nai province in the early years of the 20th century.

Construction started in 2008 with a total area of up to 529 hectares. Giang Dien Industrial Park is one of two industrial parks in Dong Nai province planned for projects in the field of supporting industries in the area.

Project name: Giang Dien Industrial Park

Location: Giang Dien commune, An Vien commune, Trang Bom district and Tam Phuoc commune, Bien Hoa city, Dong Nai province.

Investor: Sonadezi Giang Dien Joint Stock Company

Scale: 529.2 hectares

Construction start date: 2008

Project duration: until 2058

Panorama of Giang Dien Industrial Park project

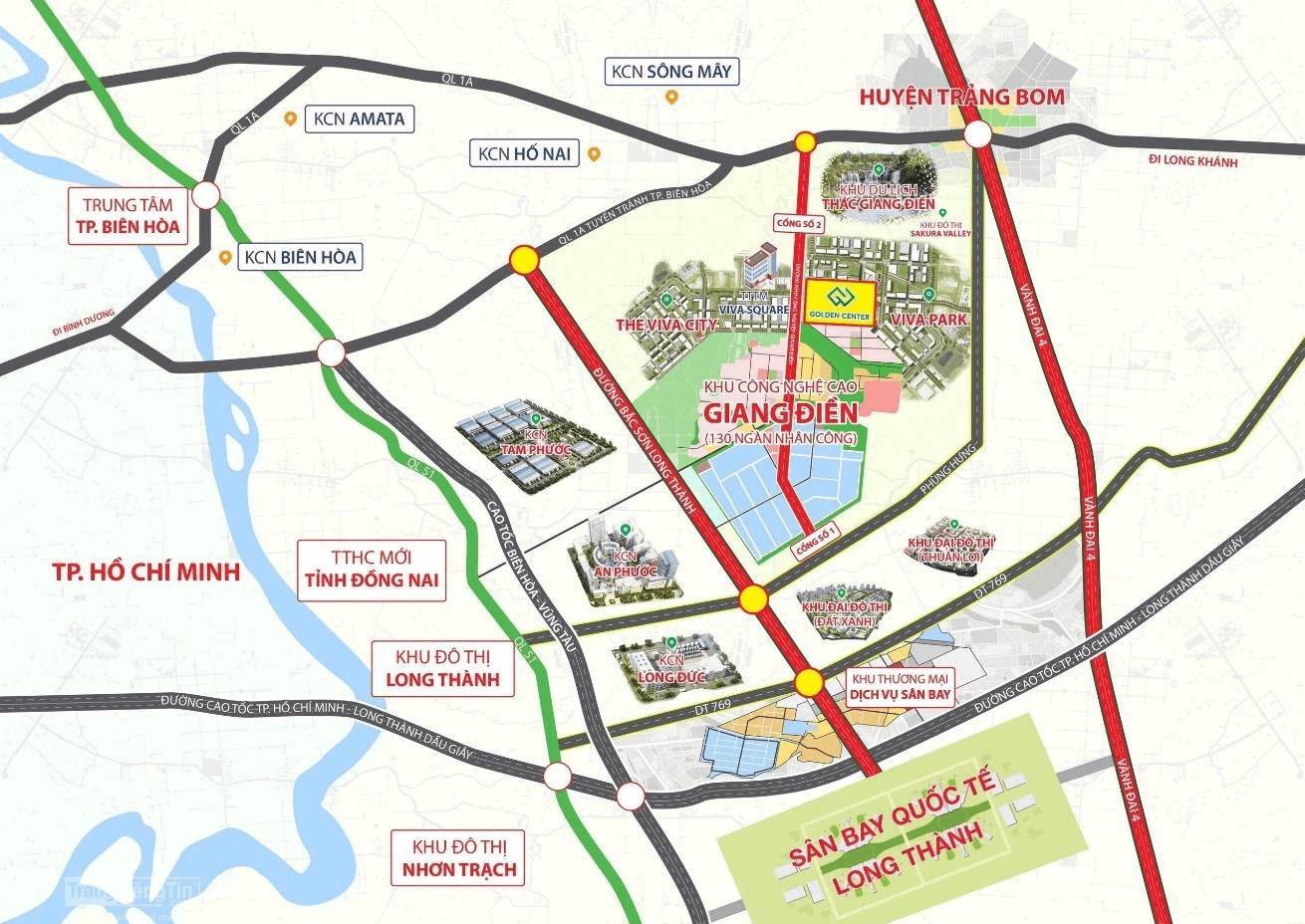

Location of Giang Dien Industrial Park

Giang Dien Industrial Park is located in Giang Dien commune, An Vien commune, Trang Bom district and Tam Phuoc commune, Bien Hoa city, Dong Nai province.

Located right next to Bien Hoa City and the gateway to Ho Chi Minh City. This place has become a “golden spot” attracting investment for many years.

Location of Giang Dien Industrial Park

Distance to Residential Area and City Center:

- Residential area and Giang Dien Waterfall Ecotourism Area: 01 km.

- Bien Hoa City Center: 20 km.

- Ho Chi Minh City Center: 44 km.

Distance to National Highways and Expressways:

- National Highway 1A route to the North: 4 km.

- Highway 51 to the West: 9km, Bien Hoa – Vung Tau national highway axis.

- City Expressway. HCM – Long Thanh – Dau Giay: 20 km

Distance to the following ports and port clusters:

- Cat Lai Port (HCMC): 43 km.

- VICT Port (District 4, Ho Chi Minh City): 56km.

- Go Dau Port: 36 km.

- Phu My deep-water port (Tan Thanh – Ba Ria): 47km.

- SP-PSA port cluster and SiTV port (Tan Thanh – Ba Ria): 51 km

- Cai Mep port: 58 km.

Distance to International Airport:

- Tan Son Nhat International Airport (HCMC): 49km.

- Long Thanh International Airport to the South: 22 km.

Infrastructure of Giang Dien Industrial Park

Internal traffic: synchronous, modern, wide road divided into 2 – 6 lanes. Along the routes are a system of trees and high-quality high-pressure lights.

Transport infrastructure of Giang Dien Industrial Park

Electricity distribution system

- Electricity is supplied from the national grid from the Song May pressure reduction station on the 110kV high voltage line and the 110/22kV transformer station.

Water supply system

- Capacity: 15,000 m2/day and night (phase 1: 5,000 m2/day and night).

Communication systems

- Support the installation of telecommunications services: IDD phone, FAX, ADSL, VoIP… Telephone and internet lines are installed according to investor’s requirements.

Waste water treatment system

- Centralized wastewater treatment plant with maximum capacity: 12,000 m/day (Phase 1: 3,000 mines/day).

- Wastewater to be treated: domestic wastewater and production wastewater.

- Wastewater treatment fees can be increased depending on the concentration of substances in the wastewater.

- The volume of wastewater charged is equal to 80% of the volume of water supplied.

- Emission standards from Industrial Parks: QCVN 24:2009/BTNMT.

Giang Dien Industrial Park wastewater treatment plant

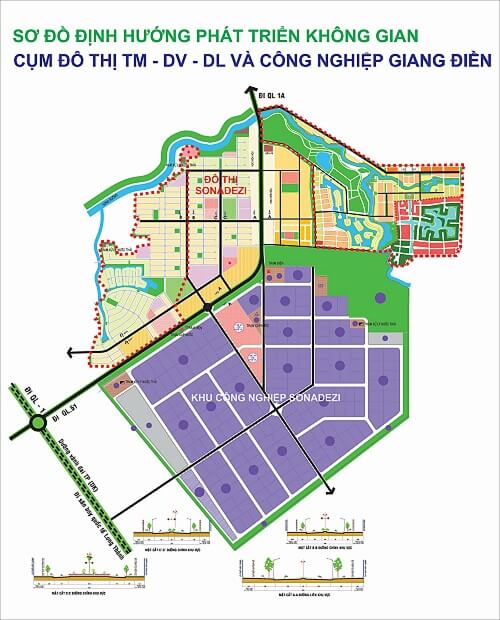

Current status of land use planning in Giang Dien Industrial Park

- Total area: 529.2 hectares

- Total land area for lease: 322.8 hectares

- Occupancy rate (by 2020): over 70%

Planning map of Giang Dien Industrial Park

Priority areas to attract investment

- Manufacturing and production of high-tech products in telecommunications and information technology

- Manufacturing and production of high-tech products in automation, mechatronics and precision mechanics

- Manufacturing and production of new, high-tech products in the field of materials

- Manufacturing and production of biotechnology products

- Manufacturing and assembling electrical and electronic appliances, digital equipment, and audio-visual equipment

- Production of electric wires and cables

- Production and assembly of vehicles and spare parts for cars, motorcycles, and bicycles

- Manufacturing and assembling all kinds of transmission motors, spare parts, and control equipment for the aviation and marine industries

- Manufacturing and mechanical processing

- Manufacture of metal products, machinery and equipment, office equipment

- Production of medical and sports equipment, children’s toys, and teaching equipment

- Production of jewelry and imitation jewelry

- Production of interior and exterior decorative products

- High quality wooden products

- Industrial products from plastic, rubber, glass

- Production of pharmaceuticals and agricultural chemicals

- Service providing food and drink rations for aircraft

- Service industries serve production in industrial parks

- Other less polluting manufacturing industries

Investment incentive policies

Corporate income tax (CIT) (Circular No. 78/2014/TT-BTC):

- Tax rate: 20% for 10 years from the first year the project generates revenue, applicable to businesses operating in industrial parks established according to Government regulations (Article 15, Decree No. 218/2013 /ND-CP and Appendix II, Decree No. 118/2015/ND-CP).

- Corporate income tax incentives for businesses operating in industrial parks: 100% tax exemption for the first 2 years and 50% reduction for the next 4 years (Clause 3, Article 20 of Circular No. 78/2014/ TT-BTC and Decree No. 12/2015/ND-CP).

- The tax rate of 10% applies for a period of 15 years (Article 19, Circular 78/2014/TT BTC) applicable to newly established enterprises from investment projects in the following fields:

- Production of software products;

- High technology as prescribed by law; scientific research and technological development;

- Production of supporting industrial products is a priority for development.

- Corporate income tax incentives for businesses operating in the above fields: 100% tax exemption for the first 4 years and 50% reduction for the next 9 years.

Export tax and import tax:

- Import tax rate: 0% for goods that are machinery, equipment, and specialized vehicles used to create fixed assets; raw materials and supplies to produce exported goods; Construction materials that cannot be produced domestically.

- Export tax rate: 0% for goods that are products manufactured for export.

Tax on transferring profits abroad:

- Completely exempt from tax on transferring profits abroad.

Value Added Tax (VAT):

- Value Added Tax applies to goods and services consumed in Vietnam and is collected through production, trade and distribution of services with applicable tax rates of 0%, 5% and 10%.

- A tax rate of 0% applies to the export of certain goods and services, including goods and services provided to industrial zones.

Planning map of Giang Dien Industrial Park project

Download high quality file of industrial park planning map: Link

Evaluation of Giang Dien Industrial Park

- The industrial park is located in the largest industrial area in Dong Nai province, near 03 densely populated areas: City. Bien Hoa, Long Thanh and Trang Bom districts.

- This is one of three industrial parks in Dong Nai province planned for projects project in the field of supporting industries.

- Conveniently connected to main traffic routes: National Highway 1A, National Highway 51, Road | Vo Nguyen Giap (bypass route of Bien Hoa city), Ho Chi Minh – Long Thanh – Dau Giay highway.

- Industrial land and factory products with diverse and flexible areas meet investor needs.

- Support investors to carry out legal procedures to apply for Investment Certificate and Business Registration Certificate.

- Internal support services are being gradually improved to serve the needs of investors and workers in the industrial park.

Vietnam Property Hub service

With a staff of many years of experience in the field of project investment implementation, with industrial park management boards, with project investors, serving many domestic and foreign investors, Việt Nam Property Hub offers the following services:

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial and service land, …

- Legal support & Investment consulting in fields related to industrial real estate.

- Connecting industrial real estate investment cooperation.

Contact for consultation