It is expected that in 2023, rental prices of northern industrial parks in the tier 1 market will increase by 5 – 10% compared to 2021.

Based on CBRE’s recent assessment, the Northern industrial real estate market continues to be lively. Over the next 3 years, the supply of industrial land in this area will increase by 3,500 hectares to serve the primary market. In addition, industrial parks in the North will expand to secondary markets such as Thai Binh. or Quang Ninh when the infrastructure system is upgraded.

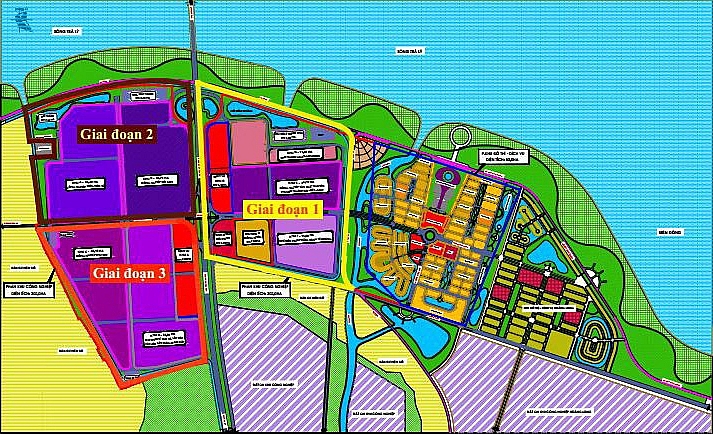

Hai Long Industrial Park, in Tien Hai district, Thai Binh, with an area of 296.97 hectares, broke ground on February 15

In 2022, the Northern industrial real estate market will record many positive changes. By the end of 2022, the number of industrial land resources of level 1 provinces in the North is 10,291 hectares, an increase of 8% compared to the previous year. Bac Ninh and Hung Yen also recorded growth in industrial parks last year.

The average occupancy rate of tier 1 markets in the North in the last quarter of 2022 reached a high of 83.2%, along with the year’s net absorption area of 519ha. Strong demand from many sectors such as electronics, solar energy, automobiles, as well as warehouse and factory developers has been demonstrated in this area.

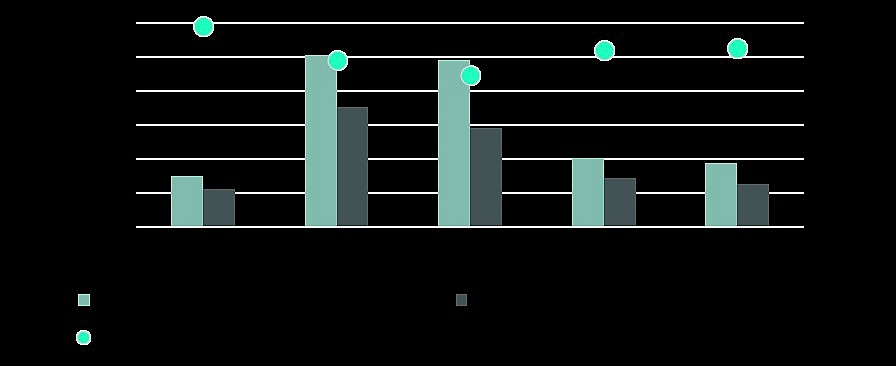

Regarding land rental prices, level 1 markets in the North reached 120 USD/m2/remaining term, an increase of 11% compared to 2021, of which the rental price growth of industrial parks in Bac Ninh and Hung Yen reached the highest level in the past 5 years, an average increase of 6-7%/year. The South also has an average price increase of 8-13%/year and 166 USD/m2/remaining lease term at the end of 2022, which is 38% higher than the North.

Based on the Northern tier 1 markets, the supply of ready-built warehouses and ready-built factories increased significantly in the past year. Specifically, the total supply of the two warehouse and workshop segments increased by 19% and 26% respectively; exceed 1.5 million m2 and 1.7 million m2 respectively.

Due to the increase in new supply, the warehouse’s occupancy rate was only 87% (down 7 percentage points compared to the previous year), while the workshop’s occupancy rate decreased by 3.5 percentage points to 84%. Both segments increased their absorption rate, both nearly 50% higher than the same period last year. The average rental price of warehouses and factories in the northern tier 1 market is 4.7 USD/m2/month, up 2% over the same period last year.

And in the next three years, the supply of industrial land will reach 3,500 hectares only for level 1 markets. Because of infrastructure reform, industrial markets in the Northern provinces are being planned. predicted to expand to secondary markets such as Thai Binh, Quang Ninh, … In 2022, CBRE believes that net absorption in secondary markets will increase, showing that the trend may develop in the future. years to come.

Based on this situation with investment supply still considered positive, and in addition to the China plus 1 strategy of many manufacturing companies, it is predicted that industrial park land rental prices in tier 1 markets will continue to increase 5-10% in 2023.

Nguồn Báo Xây Dựng